In South Africa, generational wealth transfer is a complex issue tied to historical inequalities from colonialism and apartheid. Despite these challenges, democratic reforms post-apartheid have reshaped wealth distribution, creating opportunities for intergenerational planning. Successful strategies involve long-term planning, diversification, adaptability, and tax-efficient vehicles like retirement funds and trust structures. Engaging local financial advisors who understand South Africa's cultural and economic landscape is crucial to create robust plans that bridge generations and ensure sustainable wealth transfer.

In South Africa, understanding generational wealth transfer is crucial for fostering economic stability and social mobility. This article explores the historical perspective of generational wealth in South Africa, delving into the unique challenges and opportunities presented by a nation’s diverse cultural and economic landscape. We present tailored strategies for effective wealth management across generations, equipping professionals with insights to navigate this complex yet rewarding dynamic in the South African context. Discover key approaches to optimize intergenerational wealth transfer.

- Understanding Generational Wealth Transfer in South Africa: A Historical Perspective

- Strategies for Effective Wealth Management Across Generations: Tailoring to South African Contexts

Understanding Generational Wealth Transfer in South Africa: A Historical Perspective

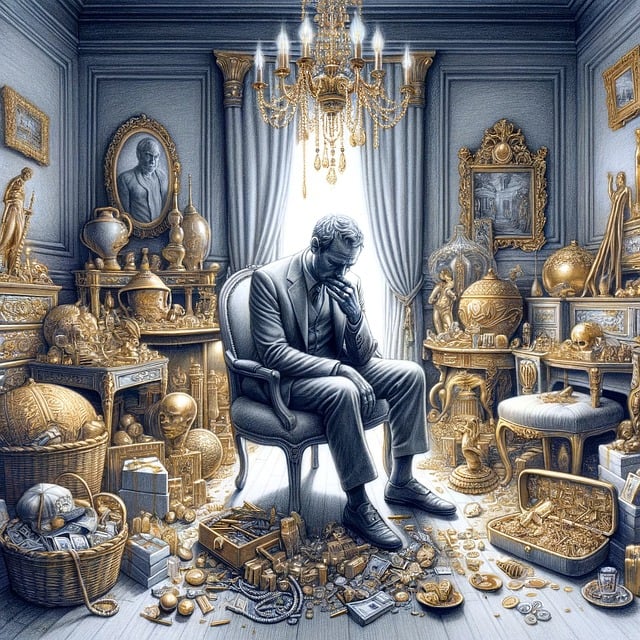

In South Africa, the concept of generational wealth transfer is deeply intertwined with the country’s history and socio-economic landscape. The journey of wealth accumulation and distribution has been shaped by significant political, economic, and social shifts over the decades. Historically, colonialism and apartheid policies created vast disparities in wealth, limiting access to resources for many communities. Despite these challenges, South Africans have exhibited resilience and entrepreneurial spirit, leading to the growth of diverse industries and the creation of substantial wealth.

Post-apartheid era, with democratic reforms, saw a shift in wealth distribution patterns. New opportunities emerged, encouraging intergenerational wealth planning. Today, Generational Wealth in South Africa involves strategic approaches to preserving and growing assets for multiple family generations. Historical experiences have taught valuable lessons about building sustainable wealth, ensuring that future generations can thrive while navigating the country’s unique economic and social environment.

Strategies for Effective Wealth Management Across Generations: Tailoring to South African Contexts

Wealth management for generations in South Africa requires strategies that cater to the unique economic and social landscape of the country. As different generations have distinct financial needs and goals, tailoring an approach that resonates with each cohort is crucial. For instance, while younger generations might focus on building a solid investment foundation and gaining financial independence, older generations often prioritize preserving wealth, ensuring estate planning, and passing down assets to future descendants.

A successful generational wealth strategy in South Africa should emphasize long-term planning, diversification, and adaptability. This includes considering tax-efficient investment vehicles, such as retirement funds and trust structures, which are well-regulated and optimized for different age groups. Additionally, engaging with local financial advisors who understand the cultural and economic nuances of South Africa can be instrumental in creating a robust plan that bridges generations, ensuring the sustainable transfer of wealth while meeting the specific needs of each generation.

In South Africa, navigating the complex landscape of generational wealth transfer requires a nuanced approach that accounts for both historical perspectives and unique contextual challenges. By understanding the dynamics between each generation—from the pioneers who built the nation to the digital natives shaping its future—wealth managers can tailor strategies that foster continuity and growth. Implementing sustainable practices and leveraging tailored solutions will ensure that generational wealth in South Africa remains a robust tapestry, enabling families to thrive and adapt over time.