Generational Wealth in South Africa is a multifaceted concept that goes beyond financial assets, encompassing cultural values and traditions passed down through generations. Families navigate a dynamic society by balancing heritage preservation with economic security through entrepreneurship, strategic investments, and community engagement. Key drivers include education access, family bonding, and financial literacy. Diversification across property, stocks, and small businesses, coupled with technology access and cultural values promoting knowledge sharing, fosters wealth creation for youth. Strategic investment diversification, clear succession planning, and tax-efficient vehicles are crucial for preserving and growing generational wealth while addressing social and financial challenges to ensure equal opportunities and sustainable economic growth.

In South Africa, understanding and harnessing Generational Wealth is crucial for securing a prosperous future. This article delves into the dynamics of building, preserving, and growing wealth across generations within the unique context of South Africa. We explore the building blocks of generational wealth, discuss effective strategies to safeguard financial security, and address the challenges that stand in the way of long-term prosperity. Discover how to navigate the landscape of Generational Wealth In South Africa for a thriving legacy.

- Understanding Generational Wealth: A South African Perspective

- Building Blocks of Generational Wealth in SA

- Strategies for Preserving and Growing Wealth Across Generations

- Overcoming Challenges: Ensuring Long-Term Prosperity in South Africa

Understanding Generational Wealth: A South African Perspective

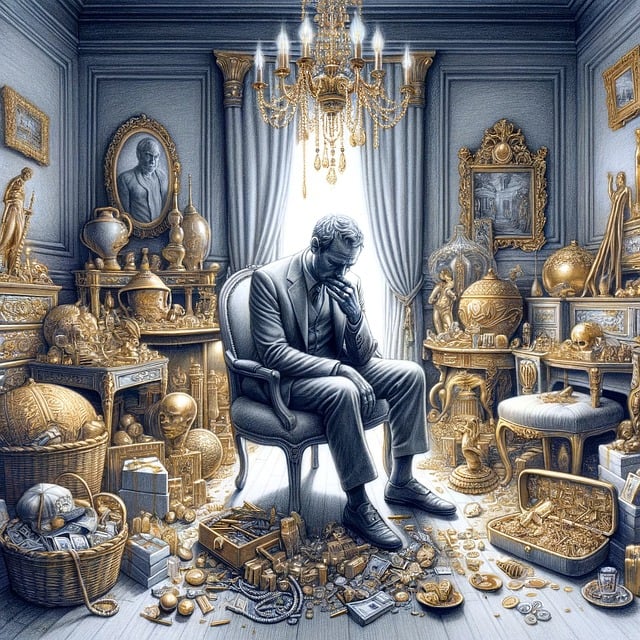

In South Africa, the concept of generational wealth is taking on unique dimensions, reflecting the country’s rich cultural diversity and complex socio-economic landscape. Generational wealth goes beyond mere financial assets; it encapsulates the transfer of values, traditions, and opportunities across generations. For many families in South Africa, building generational wealth means navigating a careful balance between preserving cultural heritage and ensuring economic security in an ever-changing world.

The journey towards creating generational wealth in South Africa often involves entrepreneurial ventures, strategic investments, and a deep understanding of community dynamics. With a diverse population and a growing middle class, the country presents both opportunities and challenges for intergenerational wealth accumulation. Key factors include access to education, fostering strong family bonds, and developing a robust financial literacy culture—all essential elements in shaping the economic future of South African families across generations.

Building Blocks of Generational Wealth in SA

In South Africa, building generational wealth involves a strategic approach that leverages unique opportunities and challenges presented by the country’s dynamic economy. The foundation starts with financial literacy—educating families on budgeting, saving, and investing early. This empowers individuals to make informed decisions, avoiding common pitfalls like excessive debt. Diversification is another key block; investors should spread their portfolios across various assets like property, stocks, and small businesses to mitigate risk and maximize returns over time.

Cultural and social factors also play a significant role. Strong family values encourage intergenerational knowledge sharing, fostering a culture of financial responsibility. South Africa’s growing entrepreneurship ecosystem provides opportunities for youth to acquire business skills and create wealth through innovative startups. Access to technology and digital platforms further enables informed investing and efficient wealth management practices, ensuring that generational wealth creation remains dynamic and inclusive.

Strategies for Preserving and Growing Wealth Across Generations

Preserving and growing wealth across generations is a key aspect of building and maintaining Generational Wealth in South Africa. One effective strategy is diversifying investment portfolios to mitigate risk and maximize returns over time. This can involve a mix of stocks, bonds, property, and alternative investments tailored to each generation’s financial goals and risk tolerance. For instance, younger generations may opt for higher-growth assets like tech stocks or startups, while older generations might focus on more stable, dividend-paying shares or real estate.

Another vital approach is establishing clear succession plans and educating family members about financial management. Regular family meetings can facilitate open discussions around wealth, goals, and responsibilities, fostering a culture of financial literacy and unity. Additionally, setting up trusts and utilizing tax-efficient investment vehicles can help protect assets from high taxes and ensure they are transferred efficiently to future generations. These strategies collectively contribute to the intergenerational transfer of wealth while safeguarding its value in the dynamic South African economic landscape.

Overcoming Challenges: Ensuring Long-Term Prosperity in South Africa

Overcoming Challenges is a significant aspect of building and preserving Generational Wealth in South Africa, where economic disparities and historical inequalities persist. The country’s journey towards prosperity requires addressing complex social and financial issues to ensure long-term benefits for future generations. One key challenge lies in bridging the wealth gap between different racial and socio-economic groups, which has been a legacy of apartheid. Implementing policies that promote equal opportunities, affordable access to education and healthcare, and sustainable economic growth can foster an environment conducive to generational wealth creation.

Additionally, navigating market volatility and creating diverse investment strategies are essential. South Africa’s economy is reliant on key industries and natural resources, making it vulnerable to global fluctuations. Building a robust financial framework, encouraging entrepreneurship, and diversifying investment portfolios can help mitigate risks and ensure stability for future generations’ financial security. By learning from past challenges and adopting innovative solutions, South Africans can chart a course towards sustainable prosperity, fostering a Generational Wealth ecosystem that benefits all.

In conclusion, building and preserving generational wealth in South Africa requires a thoughtful and strategic approach. By understanding the unique context of the country, leveraging key wealth-creation strategies, and implementing robust preservation techniques, individuals and families can ensure long-term prosperity for future generations. Navigating the challenges inherent in any economy is essential to fostering sustainable growth, making informed decisions, and safeguarding assets over time. With a focus on Generational Wealth In South Africa, these insights provide a solid foundation for those seeking to leave a lasting legacy.